Retirement Plan or IRA

Naming Can Do MS as the beneficiary of your IRA, 401K, or another qualified retirement plan is a flexible way to support families with MS and can help your heirs avoid income and estate taxes.

Close

Make your legacy commitment today to helping families living with MS for years to come.

Contact Us

As Can Do MS moves towards its 40th anniversary in 2024, we remain committed to this singular purpose; Every family living with MS must have the opportunity to thrive with access to exceptional health and wellness education programs, regardless of financial ability.

Our goal to galvanize 40 community leaders to include Can Do MS in their estate plans upon our 40 the year to fund scholarships. Making a provision in your estate plan for Can Do MS, and thereby, joining the ‘Founding 40’ Philanthropists brings scholarships to reality.

Contact Us

Gifting a portion of your estate is simple. Most philanthropists leave a legacy gift through a simple bequest in their will, although a number of easy options exist:

Retirement Plan or IRA

Naming Can Do MS as the beneficiary of your IRA, 401K, or another qualified retirement plan is a flexible way to support families with MS and can help your heirs avoid income and estate taxes.

Life Insurance

Making a beneficiary designation through your life insurance is an easy way to support Can Do MS and create an incredible legacy. You can designate Can Do MS to receive all or a percentage of your individual or group term life insurance policy proceeds.

Stocks + Assets

You can give more by avoiding capital gains taxes! By donating stock that has been appreciated for more than a year, you give more than if you sold the stock and then made a cash donation.

Will, Trust or Estate Plan

A simple and direct way to benefit Can Do MS is to leave an unrestricted bequest in your will or trust. You can choose one of three ways to make a charitable bequest: A specific amount of cash, a percentage of the donor’s total estate; or the remaining value of the estate after all other bequests have been paid.

Cash & Bank Accounts

One of the easiest and most common ways to support Can Do MS is with a gift of cash. There are several ways to make cash donations, including as an outright gift, a gift in your will, or through charitable annuities and trusts.

I [name], of [city, state ZIP], bequeath the sum of $[ ] or [ ] percent of my estate to Can Do Multiple Sclerosis, a nonprofit organization with a business address of P.O. Box 5860, Avon, CO 81620 and a tax identification number of 74-2337853 for its unrestricted use and purpose.

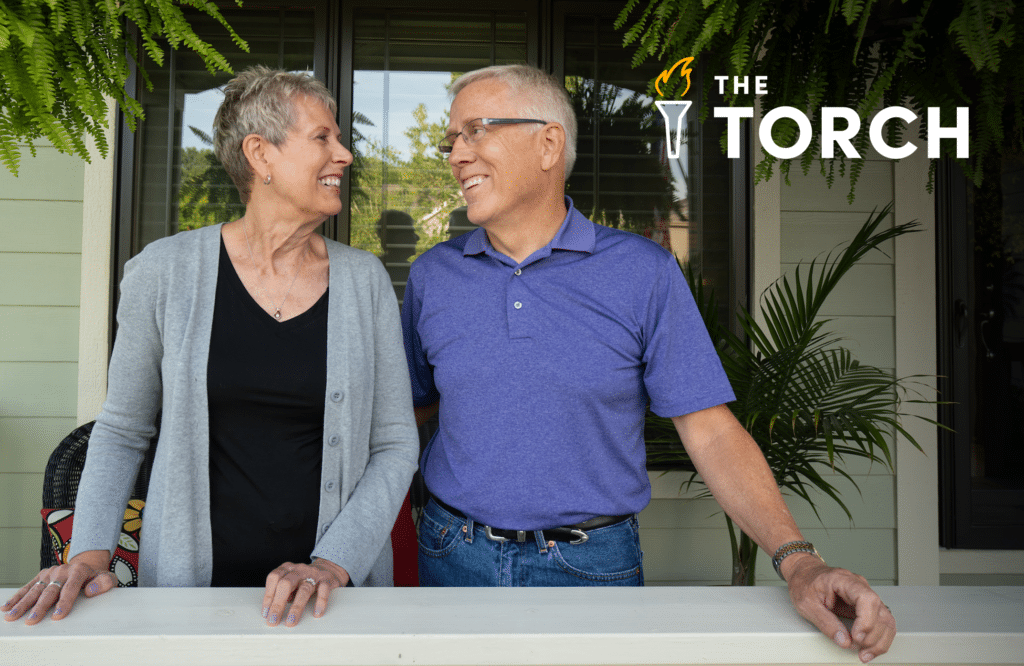

“Can Do MS was the best thing that could have happened to my family and me. They changed our lives and we want to ensure that future generations of families living with MS are able to gain the strength and knowledge to thrive. It gives us great joy to include Can Do MS in our estate plans. Please consider joining the Founding 40.”

Nikki & Jerrod Aragon

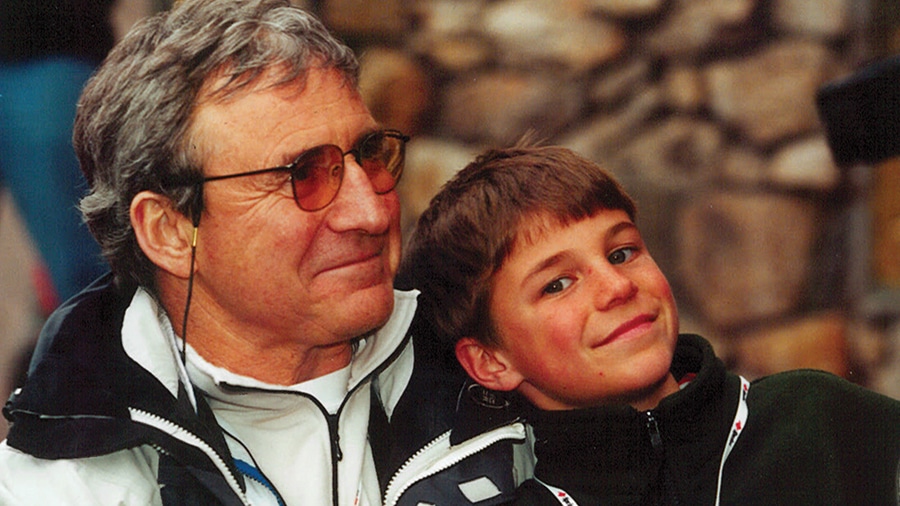

"Can Do MS is a beacon of hope for families living with MS. They are a support system you can lean on and a community that will uplift each other. It’s incredibly emotional and inspirational to see lives changed through these programs. I am honored to join the Founding 40 and carry on my father’s legacy."

Blaze Heuga, Jimmie's Son

We know this decision is an important choice to make. If you have any questions, please contact:

Lisa Mattis, Can Do MS CEO

LMattis@CanDo-MS.org

914.707.1368